portability estate tax return

Portability allows a surviving spouse to apply a deceased spouses unused federal gift and estate tax exemption amount toward his or her own transfers during life or at death. One of the biggest developments in the estate and gift tax field to come out of the recent tax act American Taxpayer Relief Tax Act Of 2012 is the permanence of the so-called portability provisions first established in 2010.

Usattorneys Com What Everyone Should Know About Personal Taxes Payroll Taxes Tax Refund Liberty Tax

It is transferred to the surviving spouse to reduce the overall estate tax once the second spouse passes away.

. For any member of a married couple who died after 2010 there is once again an opportunity to file a now very late Form 706 estate tax return to claim portability with a deadline of January 2 nd of 2018. Which allows surviving spouses including same-sex married couples to claim a carryover of the DSUE amount for any spouse who passed away in 2011 or later. Again to elect portability the deceased spouses estate has to file an estate tax return and if that isnt otherwise required that introduces some complexity and some cost into that process.

However that exemption is scheduled to return to 5000000 as adjusted for inflation in 2026. The IRS acknowledged this issue and. Depending on the size of the estate you may wish to take advantage of estate tax portability which allows a spouse to assume the tax exemption of their deceased spouse on top of their own.

The Impact of the Portability of the Federal Estate Tax Exclusion Example 1. Estate tax return preparers who prepare any return or claim for refund which reflects an understatement of tax liability due to an unreasonable position are subject to a penalty equal to the greater of 1000 or 50 of the income earned or to be earned for the preparation of each such return. This portability election increases the total exclusion available to the surviving spouse by the amount of the deceased spouses unused exclusion.

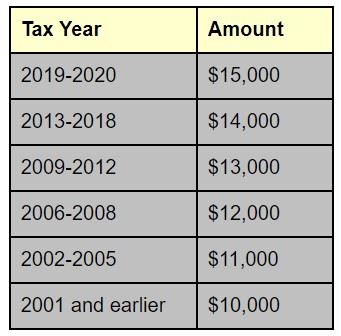

Portability occurs when a surviving spouse files an estate tax return for the purpose of calculating and capturing any Estate Tax credit left unused in the estate of the first spouse to die. Portability is a federal exemption. Portability of the estate tax exemption means that if one spouse dies and does not make full use of his or her 5000000 in 2011 or 5120000 in 2012 5250000 in 2013 5340000 in 2014 and 5430000 in 2015 federal estate tax exemption then the surviving spouse can make an election to pick up the.

The due date of the estate tax return is nine months after the decedents date of death however the estates representative may request an extension of time to file the return for up to six months. An automatic six month extension of time to file the return is available to all estates including those filing solely to elect portability by filing Form 4768 on or before the due date of. The temporary portability regulations require every estate electing portability to file an estate tax return within nine 9 months of the decedents date of death unless an extension of time for.

In order to elect portability of the decedents unused exclusion amount deceased spousal unused exclusion DSUE amount for the benefit of the surviving spouse the estates representative must file an estate tax return Form 706 and the return must be filed timely. Portability is the right of an executor to transfer or port the unused estate tax exemption from the first spouse to die to the second spouse to die. This term refers to the ability to transfer that unused portion to the surviving spouse referred to as the deceased spouses unused exemption DSUE.

In other words for DSUE portability to be claimed the executor must elect portability on the deceased spouses estate tax return. The due date of the estate tax return is nine months after the decedents date of death however the. The Estate Tax Portability Feature is Now Permanent Should You File Form 706 Even If It Is Not Required.

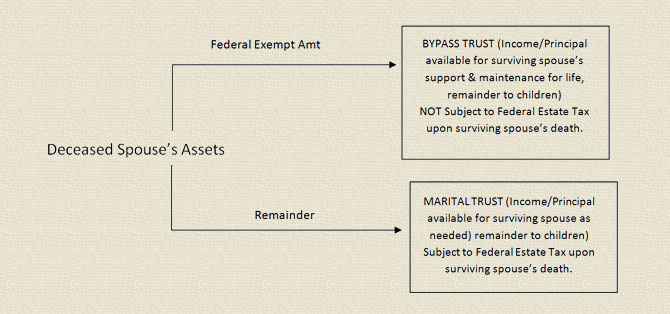

For 2020 the exemption amount is 1158 million and the IRS just announced that that amount will increase to 117 million for 2021. Importantly under New York law a separate QTIP election is not available. Prior to the enactment of the portability law in 2010 most estate plans for married couples set aside at the first.

If you dont file the 706 at the first death you cannot elect to port over this remaining amount. So this is a discussion you can have with the family to make sure they understand the cost and the potential benefits of portability and they can make the right decision of whether or not to make. The IRS thankfully has made electing portability easy.

This transfer is accomplished by completing the election on the Form 706 Estate Tax Return and can be completed without regard to the legal ownership of each spouse. Formally this is called the Deceased Spouse Unused Election DSUE. Portability allows a surviving spouse the ability to transfer the deceased spouses unused exemption amount DSUEA for estate and gifts taxes to a surviving spouse so long as the Portability election is made on a timely filed federal estate tax return IRS Form 706.

A portability election made by a non-appointed executor when there is no appointed executor for that decedents estate can be superseded by a subsequent contrary election made by an appointed executor of that same decedents estate on an estate tax return filed on or before the due date of the return including extensions actually granted. Estate tax portability can be a useful tool for couples who are creating estate plans and have a lot of assets between them and is something to be mindful of when youre estate. Estate tax return preparers who prepare a return or claim for refund which reflects.

What Does Portability of the Estate Tax Exemption Mean. Currently the federal estate tax exemption is 11400000 per spouse. This is a bizarre result leaving practitioners and clients troubled and skeptical.

The term election here means a decision made by checking a box on a tax return. If the executor timely files the decedents Form 706 United States Estate and Generation-Skipping Transfer Tax Return which generally is due nine months after the. This is called the deceased spouses unused exemption or DSUE.

To secure these benefits however the deceased spouses. A Bit of Background. Thanks to portability the surviving spouse can use the deceased spouses unused estate tax exemption and add it to their own when the surviving spouse passes away.

The estate must file a federal return to elect portability but any QTIP election made therein will be treated as null and void. Calculating the DSUE is simple. Another concept needs to be understood as well portability.

Portabilitys Effect on Tax-Efficient Estate Tax Planning.

Portability Of The Estate Tax Exemption Drobny Law Offices Inc

An Overview Of Estate Tax Portability Provisions Aicpa Insights

Portability Of The Estate Tax Exemption Drobny Law Offices Inc

This Is Another In A Series Of Blogs On The Basics Of Estate Planning Estate Planning Attorneys Do Many Th Estate Planning Estate Planning Attorney Estate Tax

Usattorneys Com What Everyone Should Know About Personal Taxes Payroll Taxes Tax Refund Liberty Tax

Vermont Estate Tax Vermont Estate Planning Lawyer Fg M

2021 Federal Tax Changes That You Should Know Today Estate And Probate Legal Group Estate And Probate Legal Group

Estate Tax Exemptions 2022 Fafinski Mark Johnson P A

Tips For Filing Taxes When Married Rings Married Married Couple

Irs Provides Relief For Small Estates To Make A Late Portability Election Wealth Management

Portability Of The Estate Tax Exemption Drobny Law Offices Inc

Usattorneys Com What Everyone Should Know About Personal Taxes Payroll Taxes Tax Refund Liberty Tax

Tackling Tax Issues If You Re An Estate Executor Ferrari Ottoboni Caputo Wunderling Llp

A Trust May Be Taxed As Either A Grantor Trust Or A Nongrantor Trust Each Type Of Trust Has Advantages And Disadvanta Estate Tax Estate Planning Grantor Trust