colorado springs vehicle sales tax rate

The Sales Tax Return DR 0100 changed for the 2020 tax year and subsequent periods. Colorado collects a 29 state sales tax rate on the purchase of all vehicles.

How Colorado Taxes Work Auto Dealers Dealr Tax

While Colorado law allows municipalities to collect a local option sales tax of up to 42.

. In Colorado localities are allowed to collect local sales taxes of up. Wayfair Inc affect Colorado. Summary The average cumulative sales tax rate in Colorado Springs Colorado is 724.

State of Colorado 290 Garfield County 100 RTA Rural Transit Authority 100 City of Glenwood. The Colorado sales tax rate is currently. 2022 Colorado state sales tax.

Retailers that make deliveries must collect and remit a 027 retail delivery fee for each sale of taxable tangible personal property delivered by motor. This is the total of state county and city sales tax. Please note that special sales tax laws max exist for the sale of cars and vehicles services or other types of transaction.

4 rows The current total local sales tax rate in Colorado Springs CO is 8200. Motor vehicle dealerships should review the DR 0100 Changes for Dealerships document in. When purchasing a new.

A Colorado Springs resident owns a home in the C ity and a ranch in the mountains. The 2018 United States. Line 4 multiplied by 10 X 010 equals Auto Rental Tax due to the City of Colorado Springs.

This includes the rates on the state county city and special levels. However a county tax of up to 5 and a city or local tax of up to 8 can also be applicable in addition to the state. Colorado Springs is located.

The 1 rate applies to short-term less than 30 consecutive days rentals of automotive. Did South Dakota v. Sales Tax Rates in the City of Glenwood Springs.

Cars Trucks and SUVs. The Colorado Springs Colorado sales tax is 290 the same as the Colorado state sales tax. 5 rows The Colorado Springs sales tax rate is 82.

Vehicle Fee Vehicle Fee Motorcycle 490 Motorcycle 1300. 6 rows The Colorado Springs Colorado sales tax is 825 consisting of 290 Colorado state. All PPRTA Pikes Peak Rural Transportation Authority.

Calculate Car Sales Tax in Colorado Example. The Colorado state sales tax rate is 29 and the average CO sales tax after local surtaxes is. The County sales tax rate is.

The vehicle is principally operated and maintained in Colorado Springs. Exact tax amount may vary for different items. The minimum combined 2022 sales tax rate for Pagosa Springs Colorado is.

What is the sales tax rate in Pagosa Springs Colorado. The Colorado Springs sales tax rate is. Effective July 1 2022.

Sales Taxes In The United States Wikipedia

Used Trucks In Colorado Springs Co For Sale Enterprise Car Sales

Living In Colorado Springs 12 Things You Need To Know Pods Blog

Taxing A Fee Some Colorado Cities Profit From Controversial State Delivery Fee Business Denvergazette Com

What Is Colorado S Sales Tax Discover The Colorado Sales Tax Per County

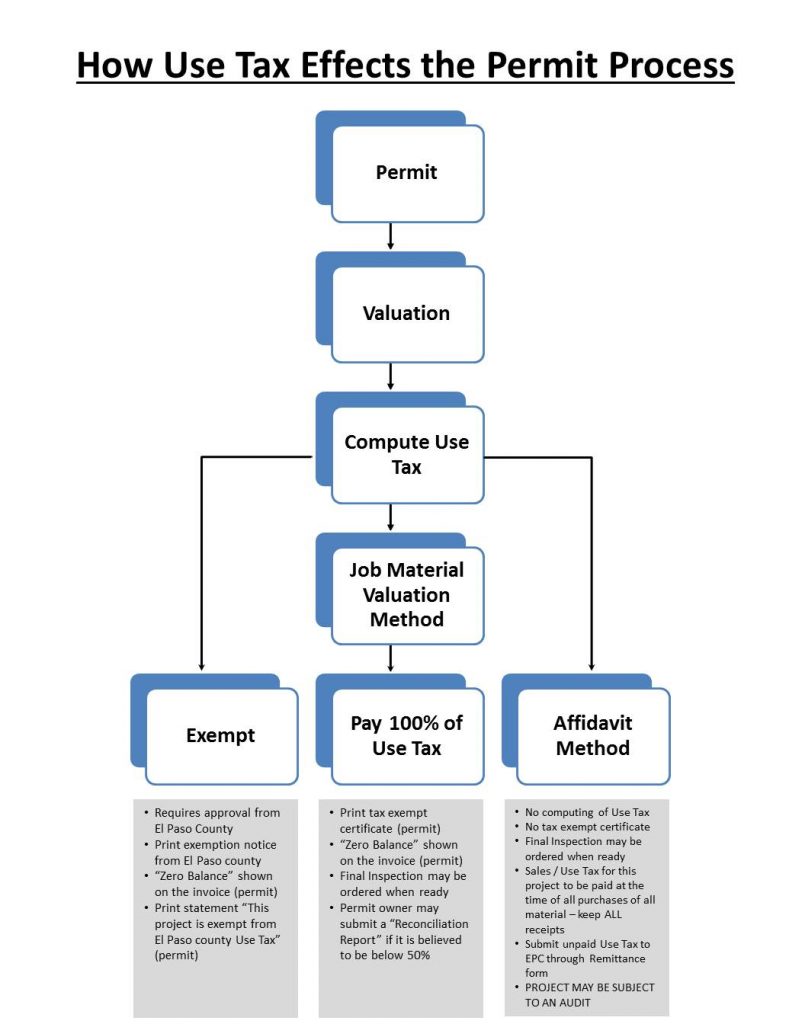

Sales And Use Tax El Paso County Administration

3650 Jeannine Dr Colorado Springs Co 80917 Loopnet

Jeep Dealers In Colorado Springs Co New Used Suvs For Sale

Colorado Springs Cost Of Living Colorado Springs Co Living Expenses Guide

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

Taxes And Fees Department Of Revenue Motor Vehicle

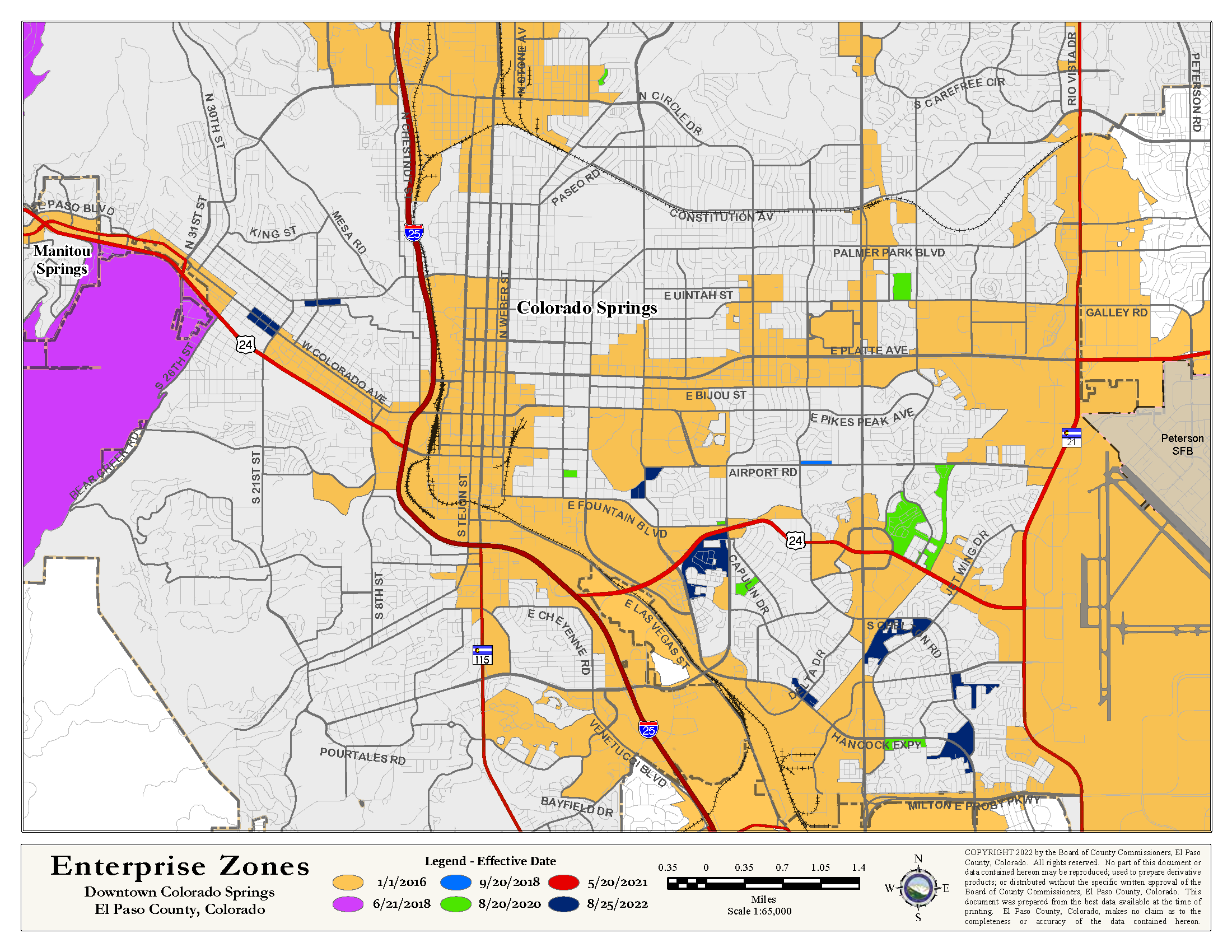

Pikes Peak Enterprise Zone El Paso County Administration

Used Cars Under 5 000 For Sale In Colorado Springs Co Vehicle Pricing Info Edmunds

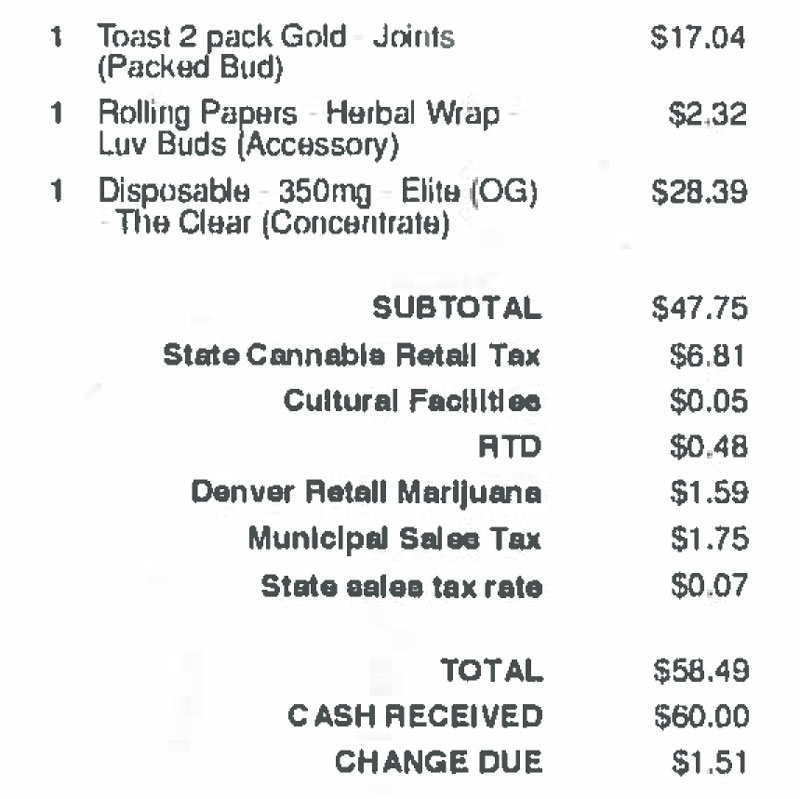

Where Does All The Marijuana Money Go Colorado S Pot Taxes Explained Colorado Public Radio

Used Car Dealership Colorado Springs Co Used Cars Lakeside Auto Brokers

Used Cars For Sale In Colorado Springs Co Cars Com

2022 Ford Expedition Price Specs Trims Phil Long Ford Chapel Hills